Will GEO Satellites Remain, or Will LEO Completely Overtake the Market?

GEO (Geostationary) satellites are unlikely to be entirely replaced by LEO (Low Earth Orbit) satellites. Instead, the two will likely coexist and serve different segments of the satellite market. Each satellite type has distinct strengths and weaknesses that make them suitable for different applications.

Reasons GEO Will Continue to Have a Role:

1 High-Capacity Broadcasting:

◦ GEO satellites can cover large areas (e.g., entire continents) with a single satellite, making them ideal for applications like TV broadcasting, weather monitoring, and certain fixed internet services.

◦ Broadcasting from GEO satellites is very efficient since their fixed position relative to Earth ensures that their coverage footprint remains constant.

2 Cost-Efficiency for Certain Applications:

◦ For services where low latency is not critical (such as one-way data transmission or high-bandwidth fixed connectivity), GEO satellites remain cost-effective since they don’t need to be replaced as often (lifespan of 15+ years) compared to LEO satellites.

3 Long-Term Reliability:

◦ GEO satellites are well-established, and the infrastructure supporting them is highly reliable. As a result, certain governments and industries may prefer GEO for stability and longevity, particularly for national security and strategic communication services.

Applications that Rely on GEO and Cannot Be Satisfied by LEO:

• Broadcasting (TV, Radio):

GEO satellites are ideal for broadcasting large amounts of data to wide regions with minimal infrastructure. The wide-area coverage and fixed position make them highly suited for satellite TV, radio, and other mass media services. LEO satellites, with their smaller coverage areas and frequent handovers, are not well-suited for broadcasting at scale.

• Weather Monitoring and Earth Observation:

GEO satellites provide continuous coverage of the same area, which is critical for applications like weather forecasting (e.g., NOAA’s GOES satellites). LEO satellites, while good for global imaging, cannot maintain continuous observation of the same spot.

• High-Capacity Backhaul for Remote Areas:

GEO satellites offer high-capacity backhaul links for remote or maritime applications where latency is not the most important factor. For areas without terrestrial infrastructure, GEO remains an economical way to provide connectivity over vast areas.

Where LEO Satellites Are Superior and Why They Will Expand:

LEO satellites are disrupting the market because they offer advantages that GEO systems struggle to match, particularly in areas like latency-sensitive applications and global reach. Here’s where LEO shines:

• Low Latency:

LEO satellites orbit much closer to Earth (500-2,000 km) compared to GEO satellites (36,000 km), resulting in lower latency (typically under 50ms for LEO vs. 600ms or more for GEO). This makes LEO systems ideal for real-time applications such as:

◦ Online gaming

◦ Video conferencing

◦ Financial transactions (where speed is critical)

• Mobile Connectivity (e.g., IoT, Maritime, Aviation):

LEO satellites provide better coverage for mobility-based applications, such as Internet of Things (IoT) devices, maritime communications, and aviation. The lower orbit allows for more reliable and faster connectivity for moving objects, like ships, planes, and connected vehicles.

• Global Coverage and Underserved Areas:

LEO constellations (e.g., Starlink, OneWeb) can provide seamless global coverage, including polar regions and other hard-to-reach areas. This makes LEO a strong candidate for connecting underserved or remote regionswhere terrestrial infrastructure is lacking.

• High-Speed Broadband:

LEO satellites can offer high-speed broadband to areas where fiber-optic infrastructure cannot reach. With their low latency and high speeds (50-200 Mbps for Starlink), they are competitive with terrestrial broadband services in rural and remote regions.

Potential Future Dynamics of the GEO-LEO Market:

• Hybrid Solutions:

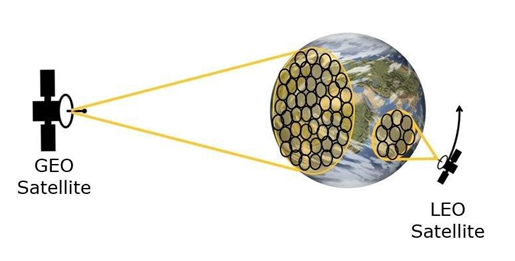

Many expect future networks to combine GEO and LEO satellites for optimized service. A hybrid approach could use GEO for applications requiring consistent global coverage, such as TV broadcasting and large-scale IoT, while using LEO for latency-sensitive tasks like broadband internet and mobile connectivity.

• Niche Specialization:

GEO satellites may become more specialized, focusing on applications where they have an edge, such as government services, fixed satellite backhaul, and broadcasting. LEO will likely dominate consumer and enterprise broadband markets and expand into mobility solutions.

Key Differences Between GEO and LEO Satellites

|

Aspect |

GEO Satellites |

LEO Satellites |

|

Altitude |

36,000 km above Earth |

500-2,000 km above Earth |

|

Latency |

High (600ms+) |

Low (<50ms) |

|

Lifespan |

~15+ years |

~5-7 years |

|

Coverage Area |

Very large (entire continents) |

Smaller footprints, requires a constellation |

|

Applications |

TV broadcasting, weather monitoring, backhaul for remote regions |

Real-time internet, IoT, mobility services |

|

Cost |

High initial deployment cost, but fewer replacements required |

High launch frequency, but lower launch costs |

|

Frequency of Replacements |

Rare, long-lasting |

Frequent satellite replacements and de-orbits |

|

Best Suited For |

Broadcasting, weather observation, high-bandwidth fixed services |

Low-latency internet, mobile broadband, IoT, underserved areas |

Conclusion: Coexistence of GEO and LEO

While LEO satellites are rapidly growing in market share, GEO satellites will continue to play a critical role in certain applications. A coexistence model is likely to emerge where:

• GEO satellites focus on large-area, high-bandwidth applications like TV broadcasting and weather monitoring.

• LEO satellites dominate latency-sensitive and global broadband applications, including mobile connectivity and remote region internet services.